Introduction

Global enterprises are actively redrawing their innovation maps. What once revolved around Western headquarters is now expanding toward Asia, driven by deep STEM talent pools, accelerating digital maturity, cost efficiencies, and policy-backed innovation ecosystems. At the center of this shift lies a powerful operating model: Global Capability Centers (GCCs).

Once limited to back-office efficiency, modern GCCs now operate as engines of innovation—supporting advanced R&D, AI-driven analytics, clinical development, regulatory science, and digital platform engineering. This change, which is backed by patent landscape analysis, is no longer a choice, it is a strategy in fields like biotechnology, life sciences, and chemicals. Asia—particularly India, Singapore, China, Malaysia, and Vietnam—has emerged as the most critical geography enabling this evolution.

Why GCCs Are Essential in Today’s Digital Innovation Ecosystem

Innovation today is distributed, data-intensive, and continuous. Centralized R&D models increasingly struggle to keep pace with accelerated discovery cycles, regulatory complexity, and global competition.

GCCs address these challenges by enabling organizations to:

- Access diverse and scalable global talent pools

- Accelerate digital and R&D capability build-out

- Embed AI, automation, and analytics directly into scientific workflows

- Reduce time-to-market without compromising quality or compliance

In life sciences and chemicals, GCCs now lead critical functions such as clinical operations, pharmacovigilance, bioinformatics, computational chemistry, regulatory intelligence, and AI-enabled discovery—capabilities that directly shape global product pipelines.

What is a GCC, and how does it accelerate Asia’s development?

A Global Capability Center (GCC) is an offshore or nearshore entity fully owned by a multinational enterprise, designed to deliver high-value capabilities across technology, science, operations, and strategy.

In Asia, GCCs play a dual role:

For enterprises:

They unlock scalable innovation, cost optimization, and access to future-ready scientific and digital talent.

For host economies:

They accelerate workforce upskilling, R&D maturity, startup ecosystems, and global integration.

Countries such as India and Singapore have deliberately positioned GCCs as national growth levers—aligning education systems, policy frameworks, infrastructure, and industry collaboration, supported by Business Model Analysis, to attract long-term innovation investments.

Market Forces Reshaping the Innovation Ecosystem

Several structural forces are redefining where and how innovation happens:

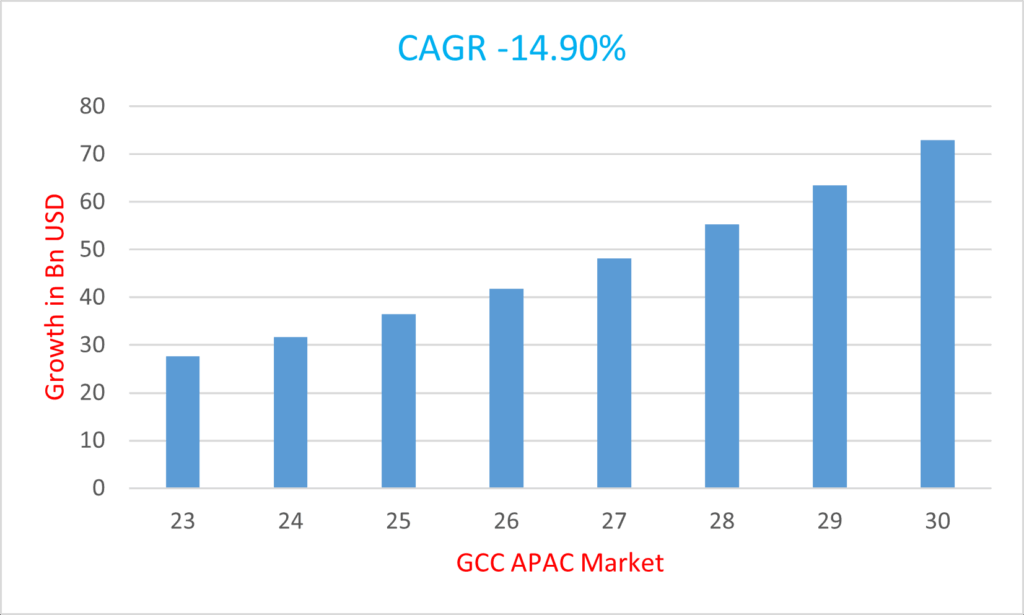

1. Explosive GCC Market Growth

Life sciences and chemical GCCs are projected to exceed USD 70+ billion by 2030, with Asia-Pacific emerging as the fastest-growing region, driven by sustained double-digit CAGR.

2. AI and Digital Acceleration

AI has transitioned from experimentation to deployment. GCCs increasingly power:

– AI-driven drug discovery and molecular modeling

– Clinical protocol optimization

– Real-world evidence and advanced analytics

– Digital health and data platforms

3. Rising Healthcare Demand in Asia

An expanding middle class, improved insurance coverage, and rising healthcare spend are creating strong market pull alongside innovation demand.

4. Manufacturing and CDMO Maturity

Asia’s mature CDMO and manufacturing ecosystems enable tighter integration from discovery to development and scale-up.

5. Government-Led Enablement

Tax incentives, special economic zones, R&D grants, and strong STEM pipelines actively support GCC establishment across Asia-Pacific.

Challenges in GCC Establishment

Despite strong momentum, GCCs face challenges that require strategic planning:

– Regulatory complexity across jurisdictions

– Intensifying talent competition and wage inflation in mature hubs

– Infrastructure gaps for advanced wet labs and resilient digital systems

– Geopolitical and data sovereignty risks

– Limited availability of senior translational and scientific leadership

These challenges do not undermine the GCC model but emphasize the need for location-specific, risk-adjusted strategies.

Innovation Enabled by Modern GCCs

Today’s GCCs drive innovation across multiple dimensions:

– AI-led drug discovery and protocol design

– Digital and decentralized clinical trials

– Real-world data analytics and evidence generation

– Cell and gene therapy research

– Radioligand, RNA-based, and advanced chemistry platforms

By enabling parallel innovation across time zones, GCCs significantly accelerate experimentation, learning cycles, and global collaboration.

Benefits for Enterprises and Ecosystems

For global enterprises:

– Faster innovation cycles

– Cost efficiency compared to Western R&D hubs

– Access to diverse STEM talent pools

– Scalable digital and scientific platforms

For host economies:

– Creation of high-value knowledge jobs

– Skill transfer and leadership development

– Stronger industry–academia–startup collaboration

– Enhanced global innovation reputation

This shared value creation positions GCCs as long-term strategic investments rather than tactical cost centers.

Asia’s GCC Landscape

India

The world’s largest concentration of life sciences and chemical GCCs, supported by deep talent pools, strong CRO networks, digital maturity, and cost advantages.

Singapore

Asia’s premium innovation and governance hub, known for IP protection, regulatory rigor, and advanced infrastructure—ideal for regional leadership and strategy.

China

High innovation velocity and strong biotech clusters, with selective deployment required due to data security and IP considerations.

Malaysia

A growing medical device and manufacturing hub with strengths in cost efficiency and regulatory certifications.

Vietnam

An emerging digital health and analytics destination supported by proactive government incentives.

Proof Point: GCC Evolution in Practice

A well-documented example of GCC evolution is Novartis in India. Over the past decade, Novartis transformed its India operations from a support center into a global innovation and R&D hub, contributing to analytics, digital platforms, and scientific programs across its global portfolio.

Key focus areas include:

– AI-driven analytics

– Cell and gene therapies

– Radioligand platforms

– Advanced chemistry and pharmacokinetics

This transformation reflects a broader industry trend: Asia-based GCCs now actively shape global science rather than merely supporting it.

The Dual-Hub Strategy

Many enterprises now adopt a dual-hub GCC strategy:

– India as the scale hub for R&D, clinical operations, data science, and AI

– Singapore as the strategic hub for governance, IP management, and high-value innovation

This model balances scale, innovation depth, regulatory confidence, and risk mitigation, making it one of the most resilient GCC structures today.

Conclusion

Global Capability Centers are no longer peripheral constructs. In Asia, they are becoming the backbone of global innovation across life sciences, biotech, and chemicals.

As talent, technology, and policy converge, Asia’s GCC ecosystem is shifting from execution to invention.

Organizations that recognize this shift early and invest strategically—backed by a strong go-to-market strategy—will define the next decade of global R&D leadership.

The future of innovation is not centralized—it is globally distributed, digitally enabled, and increasingly Asia-led.

FAQs

1. What is a GCC in simple terms?

A GCC is a company-owned center that delivers high-value capabilities like R&D, digital, analytics, and innovation for global operations.

2. Why is Asia ideal for GCCs?

Asia offers talent density, cost efficiency, digital maturity, supportive policies, and fast-growing healthcare and technology markets.

3. Which country is best for biotech GCCs?

India leads in scale and cost, while Singapore excels in governance and innovation leadership. Many firms use both.

4. Are GCCs only for large enterprises?

While large firms dominate today, mid-sized and growth-stage companies are increasingly adopting GCC models.

5. How do GCCs drive innovation?

By integrating AI, data, and advanced science into daily workflows, enabling faster experimentation and global collaboration.